Top crypto heists in recent years

In recent years, the crypto industry has suffered losses totaling billions of dollars due to vulnerabilities that have been exploited by hackers. Most of these losses have occurred on third-party custody systems e.g exchanges, hot wallets & DAOs.

Crypto heists by blockchain

Here are the top 5 crypto losses by blockchain. Ethereum leads the pack, which is unsurprising given it has the largest ecosystem and is a pioneer in the smart contracts space.

| # | Blockchain | Approximate amount lost (USD) |

|---|---|---|

| 1 | Ethereum | $4.19 billion |

| 2 | Binance smart chain | $784 million |

| 3 | Solana | $395 million |

| 4 | Avalanche | $108 million |

| 5 | Fantom | $83 million |

To date, here is a list of the most notable heists that resulted in these losses:

2022 Crypto heists

| Date | Amount | assets | Network | Perperator | Ransom |

|---|---|---|---|---|---|

| August 1st, 2022 | $190 million | ETH, BTC, USDC, USDT | Nomad bridge | unknown | N/A |

| June 24th, 2022 | $100 million | ETH, BNB, USD, DAI | Harmony's Horizon bridge | unknown | N/A |

| April 2022 | $182 million | ETH, BEAN | Beanstalk | unknown | N/A |

| March 29th, 2022 | $620.5 million | ETH | Axie Infinity's Ronin network | Lazarus group from north korea | N/A |

| February 2nd, 2022 | $326 million | wETH | Solana Wormhole bridge | unknown | N/A |

2021 Crypto heists

| Date | Amount | assets | Network | Perperator | Ransom |

|---|---|---|---|---|---|

| December 2021 | $196 million | BNB, BSC-USD, EnergyX, SPE, BabyDoge, ZOE, HERO, GMEX, STARSHIP, FLOKI, JULb, CMCX, GMR, BETU, BPAY, STACK, MOONSHOT | Bitmart | unknown | N/A |

| December 2021 | $120.3 million | ERC-20 tokens | BadgerDAO | unknown | N/A |

| December 2021 | $135 million | PYR tokens | Vulcan Forged | unknown | N/A |

| November 2021 | $139 million | assets not disclosed | Boy X Highspeed (BXH) | unknown | N/A |

| October 2021 | $130 million | ERC-20 tokens | Cream Finance | unknown | N/A |

| August 2021 | $29 million | ERC-20 tokens | Cream Finance | unknown | N/A |

| August 2021 | $610 million | ETH, BNB, USDC | Poly Network | anonymous 'Mr. White Hat' | 500,000 |

| August 2021 | $97 million | Liquid | Unknown | N/A | |

| May 2021 | $200 million | BUNNY, BNB | PancakeBunny, PancakeSwap | Unknown | N/A |

| April 19th 2021 | $81 million | EASY, USD, DAI, USDT | Polygon | Unknown | N/A |

| February 2021 | $37 million | ERC-20 tokens | Cream Finance | unknown | N/A |

2020 Crypto heists

| Date | Amount | assets | Network | Perperator | Ransom |

|---|---|---|---|---|---|

| September 2020 | $281 million | ETH, BTC, Bitcoin SV, LTC, XRP, XLM, TRX, USDT | Kucoin | Hackers from North Korea | N/A |

2019 Crypto heists

| Date | Amount | assets | Network | Perperator | Ransom |

|---|---|---|---|---|---|

| March 2019 | $105 million | ERC-20 tokens | CoinBene | Unknown | N/A |

2018 Crypto heists

| Date | Amount | assets | Network | Perperator | Ransom |

|---|---|---|---|---|---|

| February 2018 | $150 million | XRB | Bitgrail | alleged inside job | N/A |

| January 2018 | $532 million | XEM | Coincheck | unknown | N/A |

2014 Crypto heists

| Date | Amount | assets | Network | Perperator | Ransom |

|---|---|---|---|---|---|

| 2011 ~ February 2014 | $470 million | BTC | MT Gox | unknown | N/A |

Other crypto heists

November 2021

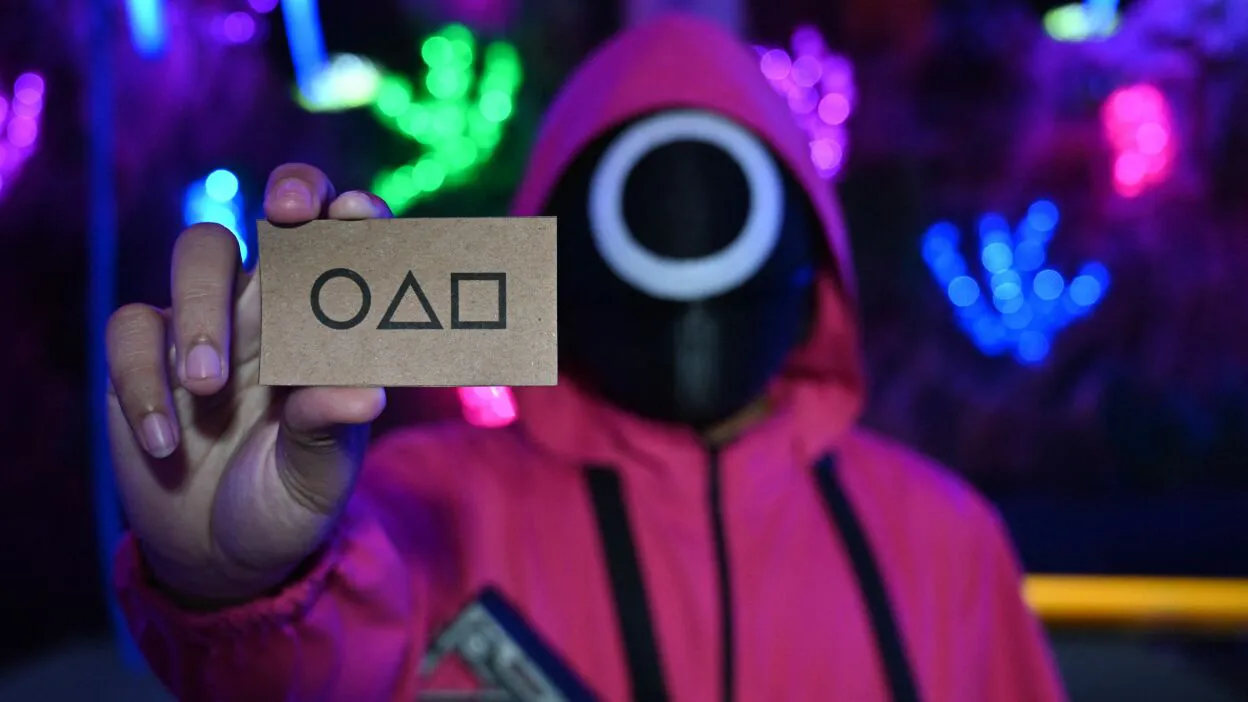

Creators Vanish with Over $3 Million in a Squid Game crypto rugpull

A virtual token inspired by the favored South Korean Netflix series Squid Game has lost almost its entire value as it was established to be a scam.

The token, Squid, which was marketed as a "play-to-earn crypto", had seen its price skyrocket in the past few days - rising by thousands of percent.

However, the token was criticized for not allowing players to resell their acquired tokens.

This kind of fraud is usually called a "rug pull" by cryptocurrency investors.

Such a scenario occurs when the promoter of a virtual token entices buyers, ends trading activity, and vanishes with the money obtained from sales.

According to the technology website, Squid's developers have vanished an estimated $3.38m.

Play-to-earn crypto is where users purchase tokens to utilize in online games and can receive more tokens which can then be exchanged for other cryptos or fiat currencies.

Last Tuesday, the token was trading at just 1 cent, but later jumped to more than $2856, in less than a week.

According to crypto data website, CoinMarketCap, Squid's value has now dropped by 99.99%.

Squid was promoted as a token that could be utilized for a new online game motivated by the Netflix series - which demonstrates the story of a group of individuals coerced to play dangerous children's games for monetary gain. The game was scheduled for launch this month.

Still, crypto analysts had warned of various tell-tale indicators that the project was likely to be fraudulent.

A most obvious red flag was that individuals who purchased Squid tokens couldn't sell them.

Critics also raised alarm over the game's website which had many grammatical errors and spelling mistakes. The website is no longer active while social media accounts promoting the tokens have since vanished.

A Cornell University economist, Eswar Prasad said, "The game is one of many schemes by which naïve retail investors are drawn in and exploited by malevolent crypto promoters."

Professor Prasad said investors need to be vigilant when buying cryptos since there is almost no regulatory supervision.

He said, "In fact, open pump and dump schemes are rampant in the crypto world, with investors often jumping in with eyes wide open, perhaps hoping that they can ride the wave and dump their holdings for a quick profit before prices collapse."

The token was available for sale on decentralized cryptocurrency exchanges including, DODO and PancakeSwap, which lets buyers connect directly to sellers, free of a central regulator.

An expert from Singapore-based firm, Openmining, Jiannan Ouyang said, "Nowadays new coins can be listed on decentralized exchanges on the first day they are created, without any regulation or due diligence."

First published on Apr 26, 2022

Bitcoin